Navigating Plan Sponsors to Achieve Better Outcomes

What We Do

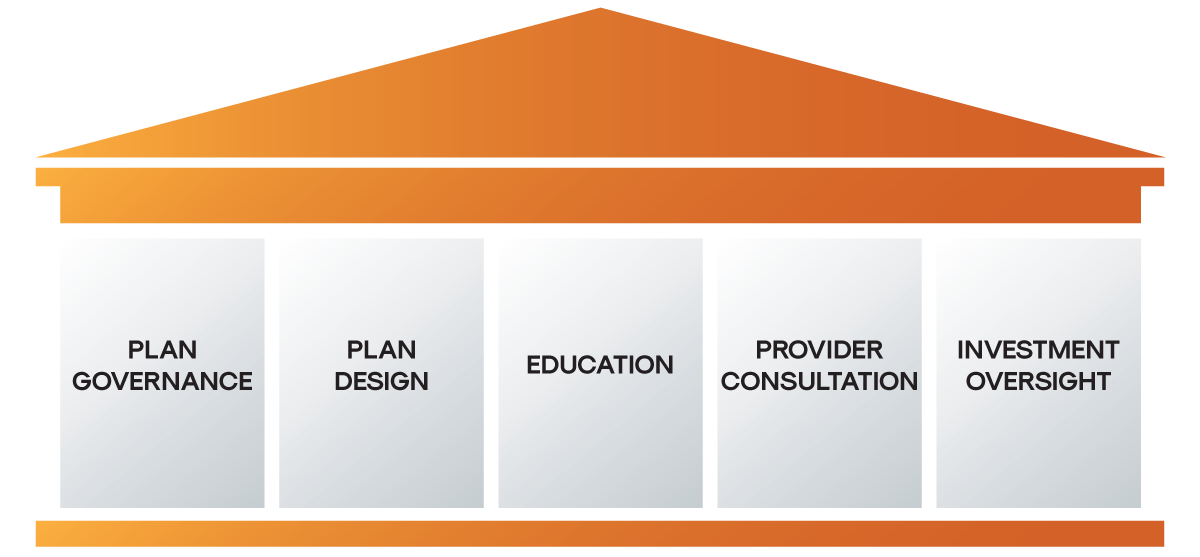

PlanPILOT’s involvement with plan governance provides a significant value-add, as we draw on our extensive knowledge of industry best practices, guidance from the DOL, ERISA counsel, and case law to provide foundational documentation and fiduciary training to each of your retirement plan committee members. Our ongoing role in plan governance includes the following services:

- Plan Document Review

- Fiduciary Compliance Checklists

- Document Development

- Record Retention

- Fiduciary Training

- 404(c) Compliance Monitoring

- Service Provider Fee Disclosure ERISA §408(b)(2) Review

- Participant Fee Disclosure ERISA §404(a)(5) Review

Learn more

While it is important to monitor plan design from a compliance and competitiveness perspective, PlanPILOT believes it is equally important to assess your plan design relative to the return on investment received by the plan sponsor. Plan sponsors should expect to receive value that exceeds their plan costs. Our plan design services are focused on:

- Maximizing Plan Sponsor and Participant Return on Investment

- Identifying and Addressing Participant Savings and Investment Gaps

- Improving Plan Participants’ Retirement Readiness

- Improving Plan Efficiency to Reduce Costs and Related Administration

Learn More

PlanPILOT leverages our industry knowledge with client plan demographics to discover the best means to educate and advise our clients’ employees. In many cases, we have discovered that education campaigns developed by recordkeepers fall well short of desired results, and yet capital continues to be expended to send these same messages to participants, year after year. The participants are ultimately paying for this education, and reshaping the recordkeeper’s communication campaign can have significant benefits. Services in this area include:

- Development of a Comprehensive Education Program

- Strategic Assistance to Enhance the Recordkeeper’s Communication Programs

- Customized Presentations and Communication Materials

- Developing and Monitoring Model Allocations

- Risk Tolerance Questionnaires/Surveys

- Coordinating Investment Advice and Financial Planning Services

Learn More

PlanPILOT’s approach to recordkeeper consultation relates to knowing the core services available and the appropriate fees that you and your plan participants should be paying for the services you are actually receiving. We have often discovered that plan sponsors are not fully aware of their recordkeeper’s services and they benefit from an increased awareness of the full breadth of services available. Services in this area include:

- Recordkeeper Review

- Service and Fee Review

- Fee Negotiations and Fee Policy Statement

- Contract Reviews

- Service Level Agreements

Learn More

A solid foundation provides the framework for a successful retirement program. PlanPILOT’s approach is driven by the establishment of appropriate policies and procedures to drive investment and plan decision-making; we view it as critical that our clients establish and follow sound practices that are supported by proper documentation. Core investment services include:

- Investment Structure Development

- Investment Policy Statement Development/Refinement

- Manager Searches

- Ongoing Performance Monitoring

- Target Date Fund Analysis

- QDIA Selection and Monitoring

- Client Reporting

Learn More