By Mark Olsen, Managing Director at PlanPILOT

After a three-year rally, the financial markets have been down for seven straight days, marking their worst slide since the pandemic decline in March of 2020. (1) Monday’s market dip put the S&P 500 down over 10%, which is officially called a “correction” on Wall Street. (2)

In addition to the stock market decline, inflation has been causing concerns. Because inflation is reaching 40-year highs, it is expected that the Federal Reserve will begin raising interest rates in the spring, which could potentially slow the economy. (3)

Investors are understandably nervous about their investments and their purchasing power, and it’s likely your employees are worried about their retirement goals. Here’s how to support them and help them keep a level head and avoid financial mistakes.

Help Them Stay Calm

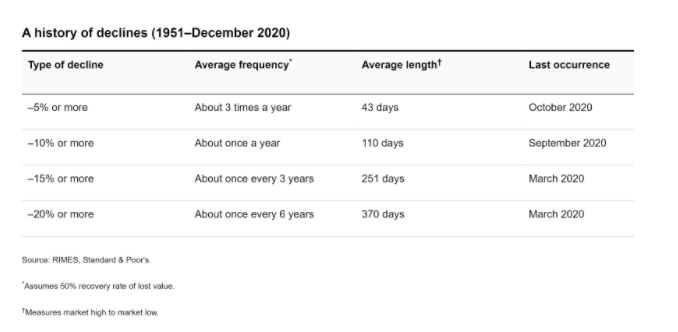

At times like these, it’s important to put current conditions into perspective. This is not the first time the market has taken a tumble and it won’t be the last. Declines in the Dow Jones Industrial Average are actually fairly regular events. In fact, drops of 10% or more happen about once a year on average: (4)

That doesn’t mean it’s comfortable to face downturns, but remind your plan participants that their target date funds are designed with volatility in mind and are built with gradually reducing risk as they draw closer to retirement.

Support Them As They Ride Out the Uncertainty Storm

It’s important to remember that markets dislike uncertainty. Currently, there is a lot of uncertainty regarding the continued coronavirus pandemic, inflation, interest rate hikes, tensions between Russia and Ukraine, and earnings reports due out for several large technology companies.

With so much uncertainty, volatility right now is extreme. The VIX, or the market volatility index, is at the highest level in nearly a year. (5) As we get more information, it is likely that day-to-day market fluctuations will decrease.

Teach Them to Play Dead

There’s an old saying that the best thing to do when you meet a bear market is the same as if you were to meet a bear in the woods: play dead. While easier said than done, successful long-term investors know that it’s important to stay calm during a market correction. We don’t know yet whether the coronavirus fears will translate into an official correction, but the risk always exists.

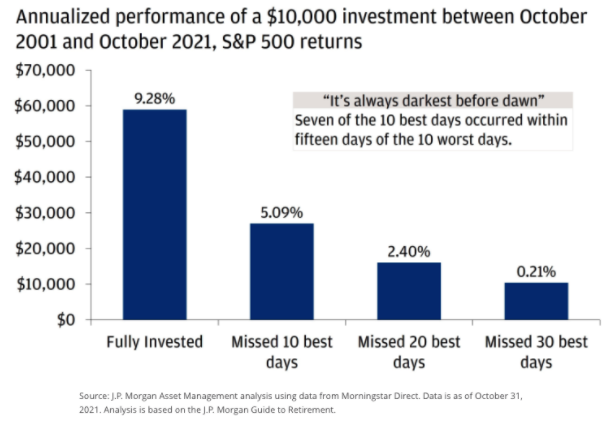

Market volatility has increased in recent years and the media can often make it seem like each episode is worse than the one before. In reality, volatility does not hurt investors, but selling when the market is down will lock in losses. You don’t want your employees’ savings to end up looking like this: (6)

Remind Them That Their Portfolio Is Diversified

Fears about inflation, volatility, and market declines are stressful. However, it’s important to keep in mind that while the stock market is down, your employees’ portfolios are made up of both stocks, bonds, and other assets that are designed to work together to decrease overall losses. It’s important for them to consider their specific portfolio, investment horizon, and circumstances when reflecting on economic events.

Review Your Investment Lineup

Now is the time to stress test your target-date funds and make sure your investment lineup is well diversified. Plan sponsors have a significant responsibility to work with an advisor to select appropriate investments, replace poor performers, and verify that the fees are reasonable. As the market changes, make sure you are still following your investment policy statement and on track to provide strong outcomes and follow DOL guidelines regardless of what the market does.

Let Us Help You With Your Plan

On a good market day, it’s a heavy responsibility to monitor your plan’s investment menu, support your plan participants, and stay in compliance with DOL regulations, let alone with the headaches today’s headlines bring. Outsourcing to a team of trusted fiduciaries may be the right next step. When you work with us at PlanPILOT, we actively select, monitor, and replace funds in your plan for you. We also serve as your dedicated plan consultant, helping you make the most informed decisions for your business. If you’re interested in learning more, give us a call at (312) 973-4913 or email mark.olsen@PlanPILOT.com.

About Mark

Mark Olsen is the managing director at PlanPILOT, an independent retirement plan consulting firm headquartered in Chicago. PlanPILOT delivers comprehensive retirement plan advisory services to 401(k) and 403(b) plan sponsors. Drawing on more than two decades of experience, Mark provides institutional retirement plan consulting to 401(k), 403(b), and defined benefit plans. His specialties include plan governance, investment searches, investment monitoring, and plan oversight. Mark is recognized as a leader in the industry and speaks at national conferences, including those organized by Pensions & Investments, Stable Value Investment Association, and CUPA-HR.

___________

(1) https://www.cnbc.com/2022/01/

(2) https://www.forbes.com/

(4) https://www.capitalgroup.com/

(5) https://seekingalpha.com/news/