By Mark Olsen, Managing Director at PlanPILOT

Demand for Outsourced Chief Investment Officers (OCIO) has skyrocketed in recent years, and a growing number of retirement plan sponsors are looking to free up internal resources by outsourcing this role. At PlanPILOT, we offer many services to help clients find the right OCIO for their needs, including a proprietary database of educational content that can be utilized throughout the outsourcing process.

Switching to an OCIO is not a decision to take lightly, especially since plan sponsors always have a fiduciary responsibility regardless of whether the investment management is outsourced or not. It is crucial that proper oversight and vetting takes place before fully transitioning to an OCIO model. If you’re thinking about outsourcing your plan’s CIO responsibilities, make sure you ask these 10 questions.

1. How Are the Total Portfolio Risks Monitored and Managed?

With access to institutional-level investment strategies and educational resources, an OCIO can help reduce risk by investing among a variety of asset classes and reacting to market changes in a timely fashion. Still, it is the responsibility of the plan sponsor to ensure the investment risks are properly monitored and managed.

A good OCIO should be able to provide a detailed outline of how risks are monitored and what steps are taken if the investment risk level gets too high. Don’t settle for a non-answer, and don’t be afraid to probe deeper if you don’t understand the response. This is standard operation for any OCIO and they should be able to explain it in a way you can understand.

2. Is the Total Portfolio Stress-Tested?

Stress-testing is a common technique used in the financial services industry to ensure a particular portfolio or investment plan will hold up under a variety of scenarios, including prolonged market downturns and economic volatility. It is crucial that your OCIO stress-test the portfolio. It’s one thing to produce impressive returns when the market is going up, but how will the portfolio react during a bear market?

In addition to whether or not the portfolio is stress-tested, you should also find out how frequently it undergoes these tests. The market is ever-changing and you can’t rely on stress tests from years ago to hold weight in today’s current economic environment.

3. How Often Is the Asset Allocation Rebalanced?

Similar to the stress test above, asset allocation rebalancing is an important part of any investment plan. You can start off with a 60/40 allocation of stocks to bonds, but over time this can become more like 90/10 if the stocks significantly outperform the bonds. A 60/40 allocation has a much different risk profile than a 90/10 allocation, and without rebalancing, you can quickly take on way too much risk for your stated objectives.

A common rule of thumb is to rebalance the allocation whenever it deviates more than 5% from the desired goal, or at least quarterly. If your OCIO is not rebalancing, or is not rebalancing often enough, it could be a sign that you should find someone else.

4. How Do You Negotiate Favorable Investment Management Fees?

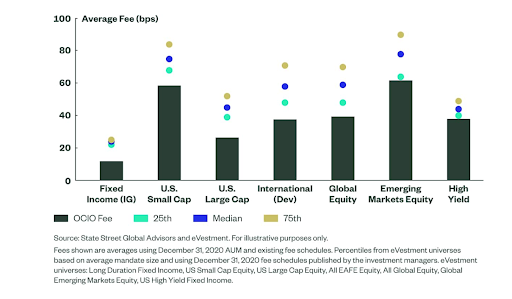

A huge benefit of working with an OCIO is their ability to leverage the size of their firm to negotiate reduced management fees. This is a win-win for everyone involved as the cost savings can be passed along to employer-sponsored retirement plans, endowments, foundations, and ultimately benefit plan participants and beneficiaries.

Understanding how an OCIO negotiates favorable investment management fees, and how much of a discount you can expect, is a useful piece of information when comparing candidates.

As you can see in the chart below, the institutional buying power of an OCIO can be significant, saving a substantial amount in management fees over time: (1)

5. What Is the Investment Oversight Process?

An OCIO adds another layer of fiduciary protection to a plan’s portfolio by overseeing day-to-day transactions and management decisions. But this layer of protection is only as good as the underlying investment oversight process.

If the OCIO is not sufficiently competent in choosing investments that meet the risk and return objectives of your particular plan, then it could lead to fiduciary liability as a plan sponsor down the line. Be sure to ask about how the investment oversight process would be applied to your particular plan’s objectives, and also inquire about the OCIO’s experience with similar institutions and how it has influenced or informed their oversight process.

6. What Is Your Firm Doing to Address Diversity, Equity, and Inclusion?

Diversity, equity, and inclusion (DEI) is a growing subset of socially conscious investment considerations that seeks to align a company’s stated values with what they do in practice. This is accomplished by promoting greater representation and diversity in corporate and financial spaces.

DEI has grown substantially in the last several years, with a 123% job increase between May and September 2020, (2) and many businesses have started to incorporate DEI considerations into their business plans as investors demand accountability from the corporations they invest in. As many plan participants shift their focus to more socially conscious investment options, it’s important to understand what your OCIO is doing (if anything) to meet the objectives of plan participants.

7. How Does ESG Factor into Your Investment Decision-Making?

DEI is not the only socially conscious investment option to consider as you look for an OCIO. ESG investing is another growing trend to keep in mind.

ESG is a strategy that reviews the environmental, social, and governance practices of a specific company and assesses how those practices might impact the company’s performance in the stock market. ESG aims to examine the total ethical impact of an investment and align investors’ portfolios with their moral values.

Like DEI, ESG is growing in popularity among both institutional and retail investors. Understanding your OCIO’s willingness and ability to provide this option is an important factor to consider.

8. How Do Abnormal Returns Alter the Risk Profile and Asset Allocation?

In a perfect world, portfolio returns would never be “abnormal.” But, unfortunately, this isn’t a perfect world and it’s important to understand how your OCIO would react in the event of a worst-case scenario.

What if the portfolio experiences abnormally low returns due to a huge market drop? How will abnormal returns affect the risk profile and asset allocation of the entire portfolio? What processes does the OCIO have in place to ensure this happens automatically rather than taking several months of poor returns before being adjusted?

Questions like these will ensure you are doing your due diligence as a fiduciary when searching for the right OCIO.

9. Is Revenue Shared or Received From Any Source Other Than Asset Management Services?

This question is absolutely critical so that you fully understand any and all potential conflicts of interest that may stem from hiring a particular OCIO. Are there any investment products that are included or excluded due to a financial incentive on the part of the OCIO? If so, what is the financial incentive, and is it being properly disclosed to all relevant parties?

The quickest way to get yourself into hot water as a fiduciary is failing to disclose conflicts of interest or making choices based on your own interest rather than the plan participants’. Even if your investment management is outsourced and you are not making the day-to-day decisions, you can still be held liable for failing to disclose conflicts of interest. Not knowing is not a good enough excuse, so be sure you are fully informed on how your OCIO is compensated and if any conflicts of interest exist.

10. Is Your Performance GIPS Compliant?

The Global Investment Performance Standards (GIPS) is a set of standardized investment reporting procedures that aim to make it possible to compare the investment performance of one manager against another’s. The system is completely voluntary, so not every OCIO will be able to claim the GIPS compliant rating.

If you make it a point to only consider OCIOs who are GIPS compliant, you will be able to easily compare their past investment performance. While past performance is no guarantee of future returns, it’s still important to know how an OCIO has performed against appropriate benchmarks.

Do You Need Help Finding an OCIO?

Are you looking to outsource your CIO responsibilities and overwhelmed with the due diligence process? Or is your current OCIO failing to meet all your expectations? Working with a firm who can assist you in evaluating your current provider can help you feel confident that you’re making the best decision for your plan and your participants.

At PlanPILOT, we have extensive industry experience and provide the level of expertise you need. Call us at (312) 973-4913 or email mark.olsen@PlanPILOT.com.

About Mark

Mark Olsen is the managing director at PlanPILOT, an independent retirement plan consulting firm headquartered in Chicago. PlanPILOT delivers comprehensive retirement plan advisory services to 401(k) and 403(b) plan sponsors. Drawing on more than two decades of experience, Mark provides institutional retirement plan consulting to 401(k), 403(b), and defined benefit plans. His specialties include plan governance, investment searches, investment monitoring, and plan oversight. Mark is recognized as a leader in the industry and speaks at national conferences, including those organized by Pensions & Investments, Stable Value Investment Association, and CUPA-HR.

________

(1) https://www.ssga.com/us/en/institutional/ic/insights/five-questions-to-ask-an-ocio

(2) https://insights.grcglobalgroup.com/the-history-and-growth-of-the-diversity-equity-and-inclusion-profession/