Since the auditing changes regarding 403(b) plans changed in 2009, it is essential for plan sponsors to know what to look for when selecting an independent auditor for their retirement plan. Once you understand whether or not your retirement plan requires an audit and what type of audit is most appropriate for your situation, it’s time to find an auditing firm that meets your needs. It’s important to select a trustworthy and experienced audit firm.

As you evaluate the services and aspects of multiple firms, keep these important traits in mind:

Independent Qualified Public Accountant

While some of the other characteristics of choosing a firm are based on the decision you feel best, this one is mandatory. The auditor must be licensed or certified as an Independent Qualified Public Accountant (IQPA) by a State regulatory authority. To be independent, the accountant or a member of their firm must not have or be committed to any financial interest in the plan sponsor or be connected to the plan or plan sponsor, such as a promoter, underwriter, advisor, director or trustee, in any way.

Additionally, the accountant must not maintain financial records for the employee benefit plan. If the Department of Labor challenges the independence of your accountant, they can reject your audit as incomplete. An incomplete audit could possible result in $1,100 per day in non-filing penalties.

Reputation and Experience of Audit Firm

First and foremost, if you are new to the auditing process, it is important to have trust in the company you choose. To gain trust in firms before meeting or speaking with them, conduct background research on multiple different firms to get a feel for which firm will provide the best audit. A referral from someone you trust may also help lead you in the correct direction when looking for an auditing firm to audit your retirement plan.

Following this initial research, meeting with several firms face-to-face or talking with them over the phone will help you get a better understanding of how they operate. Someone with experience will want to talk with you to ensure they can address all of your wants and needs during the auditing process.

To gauge an auditing firm’s experience, it is helpful to know how many audits they have performed over the course of their existence as well as the most recent year. If a firm has been around for multiple years you will know they have experience with the auditing procedure, especially since 2009 with the newer 403(b) audits. However, there is also something to be said about the number of audits firms as a whole perform. If an individual auditor is averaging more than 15 audits per year, it should raise a red flag about the firm. With an average that high, it usually means the auditor is rushing through their audits and not spending enough time with each individual audit. When this happens, mistakes tend to pass through causing thousands of dollars in problems down the line to correct the mistake.

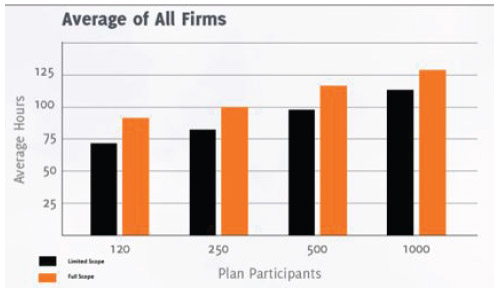

As you can see from the graph below, depending on the type of audit you are having completed and how many participants you have, audits can take an extremely long time to finish. When choosing the auditing firm for your plan, be sure to look into their experience as well as the amount of work the firm is requiring out of their auditors.

Price

Although most people believe they need to have one of the Big 4 accounting firms (Deloitte, PricewaterhouseCoopers, Ernst & Young, or KPMG) audit their plan, there are many other qualified accounting firms out there.

With larger firms, you are almost guaranteed to have quality results; however you are less likely to get the personal relationship wanted between you and your auditor. These smaller firms typically perform just as well of a job as the bigger firms for a less expensive cost since they do not have the name behind them as one of the Big 4.

The cost of an audit will vary depending on the size of your company as well as the state your financial books. Choosing the firm with the cheapest bid is not always the most beneficial route to take. You need to have a price in mind in which you feel comfortable paying, but it also needs to be reasonable in comparison to the other bids you have been receiving. After receiving multiple bids, do not be afraid to negotiate the price of one company with another that you may have liked better. Negotiating the price will often help lower the price of the other bids.

Next Steps

Finding an auditor for your plan requires a lot of time and effort. Don’t rush the process and give yourself enough time so you can meet with several firms before selecting one. If you’d like more information or guidance on finding an audit firm for your 403(b) plan, we’d be happy to meet with you. Give our office a call at (312) 973-4911 or email us at info@planpilot.com.

Related Posts

Why Plan Sponsors Should Hire a Retirement Plan Consultant - Learn why plan sponsors choose to work with a retirement plan consultant, as well as a few of the questions you'll want to ask if… ...Read More

Why Plan Sponsors Should Hire a Retirement Plan Consultant - Learn why plan sponsors choose to work with a retirement plan consultant, as well as a few of the questions you'll want to ask if… ...Read More Key Components of an Effective Retirement Plan Committee - An organized, well-managed retirement plan committee is a key foundation of a successful retirement plan. Forming an effective retirement plan committee not only fosters more… ...Read More

Key Components of an Effective Retirement Plan Committee - An organized, well-managed retirement plan committee is a key foundation of a successful retirement plan. Forming an effective retirement plan committee not only fosters more… ...Read More Improving Your Retirement Plan Governance - It is not hyperbole to suggest that you as a retirement plan sponsor must take seriously your fiduciary responsibility. This includes plan governance, such as… ...Read More

Improving Your Retirement Plan Governance - It is not hyperbole to suggest that you as a retirement plan sponsor must take seriously your fiduciary responsibility. This includes plan governance, such as… ...Read More