Meeting Your Fiduciary Responsibilities

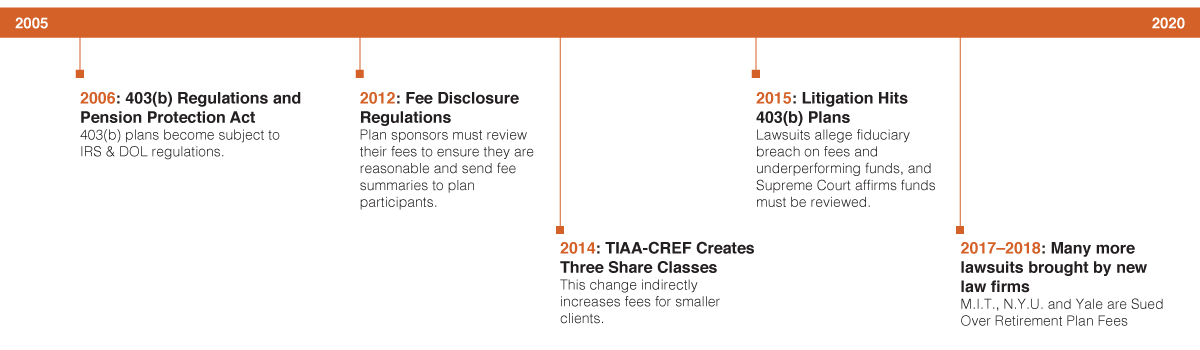

Managing a 403(b) plan isn’t easy. Since 2006, the Department of Labor’s regulation of 403(b) plans has become increasingly complex and time consuming. Recent regulations, in effect since 2012, are the fee disclosure regulations, which require schools to determine if the fees paid to investment managers and retirement plan service providers are “reasonable.” Unfortunately, the Department of Labor did not create a template or checklist for plan sponsors, so this interpretation is sometimes challenging.

Every year, plan sponsors receive complicated fee disclosure reports and often the important task of reviewing fees for reasonableness falls by the wayside. Why? Plan sponsors simply don’t have a transparent view of their plan’s fees or the tools and expertise to analyze them. (The annual audit of the plan does not provide help, as auditors are required to check only that fees are accurate, not that they are reasonable).

Vanguard summarized plan sponsor reaction well in a 2016 whitepaper: “While plan sponsors undoubtedly benefit from receiving more comprehensive and more uniform disclosures, many sponsors wonder what it all means for them. … [They] understand they have a fiduciary duty to ensure that plan fees are reasonable, but they repeatedly ask how to determine reasonableness.”

Also, many plan sponsors don’t realize their retirement plan’s fees have likely gone up dramatically in the last five years or that cheaper funds or share classes within funds are now available. In addition to reviewing fees, in a 2015 landmark ruling, the Supreme Court reaffirmed that plan sponsors have a fiduciary responsibility to review their plan’s investments regularly, at least annually.

Benchmarking Fees and Funds

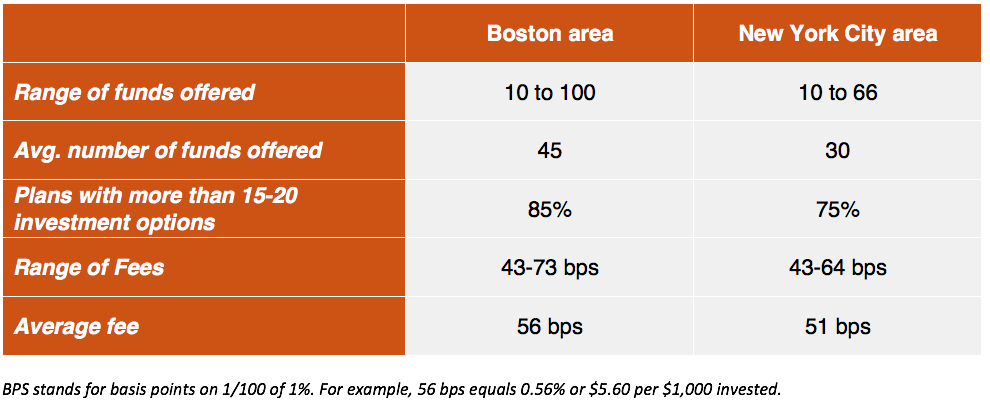

To help Business Officers better understand their school’s situation and evaluate whether employees are getting good value for their fees, PlanPILOT shares the findings of research on trends in plan fee trends and investment line-up design. Using publicly available IRS Form 5500 information, PlanPILOT examined more than 750 plans, with NBOA schools comprising roughly 20% of plans.

Results revealed a wide range of fees and demonstrated the vast majority of plans had significantly more than 15 to 20 funds, the maximum recommended by many experts. The study also found 403(b) plans typically have individual contracts, which creates a hurdle: to take advantage of any new funds added to the investment line-up, each employee must move their money to a new fund instead of the plan sponsor being able to make the moves pro-actively. This barrier effectively traps most of the plan’s assets in an outdated or “legacy” investment structure.

Our Research Findings on Independent School 403(b) Plans

The size of plans reviewed ranged from $5-$100M. The first round of results are for schools in the Boston and New York City areas, but PlanPILOT will continue to expand the study in 2020. For the Boston area, we studied more than 300 plans; for New York City area, we studied more than 200 plans.

PlanPILOT’s Annual 403(b) Plan Review Checklist

Reducing Risk, Improving Outcomes

To ensure your school is in compliance, consider two areas.

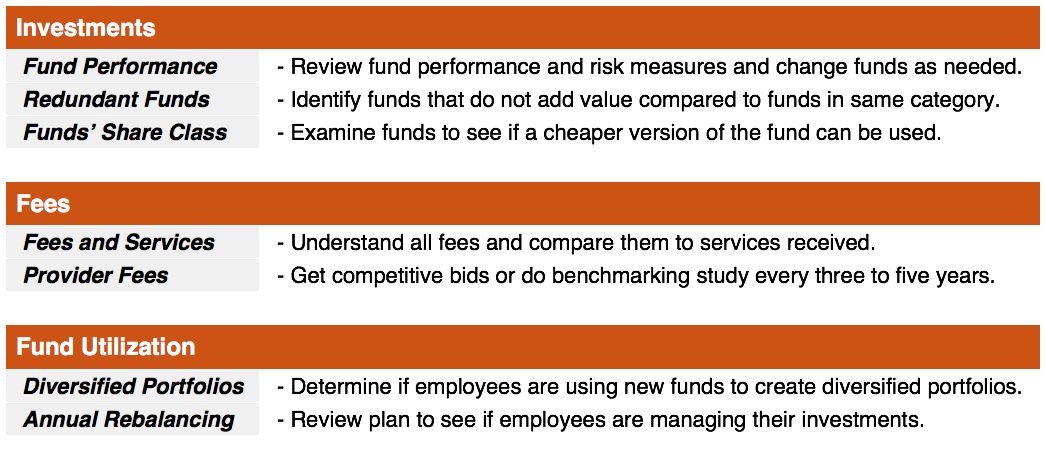

First, implement strong governance and management processes by setting up a retirement committee whose sole focus is to manage your fiduciary responsibilities. Often an initial step is to transition to what is referred to as an “open architecture” investment line-up, adding funds from outside investment managers, that is, expanding the investments offered beyond the record keeper’s funds. Moving to a “best-in-class” approach — adding a greater diversity of funds from firms who specialize in specific investment disciplines and closing funds which underperform — helps schools ensure their fiduciary responsibility.

Second, reduce your school’s risk and protect the plan’s fiduciaries by hiring an independent consultant who is prepared to be a fiduciary to the plan and is conflict-free. Several of the settlements of 403(b) lawsuits have included a requirement that the plans involved hire an advisor.

The bottom line is, to avoid personal liability — and to be clear, the liability is personal, in addition to being institutional — plan fiduciaries must review fees to ensure they are reasonable and document how they came to that conclusion.

Get Expert Help

Those who are uncertain as to how best to proceed should consider contacting an independent Registered Investment Advisor, such as PlanPILOT for help. We can help you review, understand and document the various levels of fees for your plan. Plan sponsors also rely on us to review fund lineups and provide scorecards of investments, highlighting any changes recommended. Contact us today at (312) 973-4911 or email info@planpilot.com.

Related Posts

Why Plan Sponsors Should Hire a Retirement Plan Consultant - Learn why plan sponsors choose to work with a retirement plan consultant, as well as a few of the questions you'll want to ask if… ...Read More

Why Plan Sponsors Should Hire a Retirement Plan Consultant - Learn why plan sponsors choose to work with a retirement plan consultant, as well as a few of the questions you'll want to ask if… ...Read More Evaluating Your Plan’s Recordkeeper - Learn more about the role a plan recordkeeper plays and some of the factors plan sponsors should consider when choosing and evaluating a recordkeeper. ...Read More

Evaluating Your Plan’s Recordkeeper - Learn more about the role a plan recordkeeper plays and some of the factors plan sponsors should consider when choosing and evaluating a recordkeeper. ...Read More Benefits of an OCIO Search Consultant - There are many reasons it can make sense to outsource your chief investment officer (CIO) functions and duties, but finding the right OCIO manager is… ...Read More

Benefits of an OCIO Search Consultant - There are many reasons it can make sense to outsource your chief investment officer (CIO) functions and duties, but finding the right OCIO manager is… ...Read More